Planning an exciting trip to the dazzling Arabian country of Qatar? Don’t forget to secure proper travel health insurance before your journey! As of February 1, 2023, Qatar made it compulsory for all international visitors to have adequate medical coverage during their stay.

This new rule aims to provide visitors with safe, hassle-free treatment if any medical emergencies or accidents occur while vacationing in Qatar.

It also helps regulate healthcare expenses and upgrade Qatar’s medical facilities.

In this article, we delve into the significance of this new rule, its implications for visitors, and how you can navigate the process seamlessly, ensuring a worry-free and unforgettable experience in Qatar.

Who Needs Qatar Travel Insurance?

Anyone applying for a visa must purchase an approved travel health plan. Even those eligible for a Visa on Arrival at Qatar’s borders need insurance if extending their stay beyond 30 days.

Exemptions and Recommendations for Qatar Travel Insurance

While Qatar’s travel health cover is mandatory for most visitors, there are a few exemptions to be aware of:

- Stays under 30 days: Insurance is not legally required, but still highly recommended

- Australian citizens on short visits: Usually exempt from needing insurance

- GCC nationals: Gulf region citizens are spared this regulation

However, it’s always advisable to get insured regardless of exemptions. Medical emergencies can happen unexpectedly, even on shorter trips. Having that extra coverage provides invaluable protection and peace of mind during your Qatar travels.

GCC Nationals Exempt from Qatar Visitor Insurance

The Ministry of Public Health in Qatar has clarified that citizens of the Gulf Cooperation Council (GCC) countries are exempt from the new mandatory health insurance requirements for visitors to Qatar. This exemption applies as the first phase of Qatar’s Health Insurance Scheme took effect on February 1, 2023.

As stated by Dr. Yousef Al Maslamani, Medical Director of Hamad General Hospital, “The law does not apply for citizens from Gulf Cooperation Council, only to other visitors.” GCC nationals visiting Qatar will not need to purchase the compulsory visitor’s health insurance policy.

This exemption is in line with Qatar’s Law No. 22 of 2021 regulating healthcare services, which made health insurance mandatory for all other international visitors entering Qatar. While non-GCC tourists must have at least basic emergency and accident coverage, GCC citizens are spared this requirement during their stays in the Qatari nation.

Steps to Get Travel Health Insurance For Visitors To Qatar

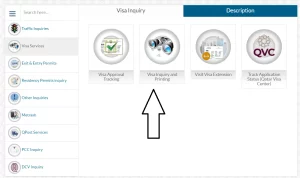

Step 1: Apply for Qatar Visit Visa

Apply for your Qatar visit visa through the Metrash app.

Step 2: Choose an Approved Provider

You’ll be prompted to choose an insurance provider approved by Qatar’s Ministry of Public Health (MOPH).

Step 3: Purchase the Plan Online

After selecting a company, complete the quick purchase process online.

Step 4: Visa Issuance with Insurance

Your visa will be issued once you have the mandatory insurance policy.

Step 5: Access Your Policy Documents

Print or save your policy documents to present when required.

What is the Cost of Qatar Travel Insurance?

The standardized insurance premium is an affordable QR50 (around $14) for a minimum 30-day coverage period. You can buy extended coverage from MOPH-approved providers if your visit is longer.

This basic visitor’s plan covers:

- Emergency medical treatment up to QR150,000

- Ambulance transport costs up to QR35,000

- COVID-19 treatment up to QR50,000

- Quarantine expenses up to QR300 per day

- Repatriation costs up to QR10,000

With straightforward purchase and low pricing, getting insured is a no-brainer for safe, breezy travels in Qatar! Simply follow the mandated process while planning your trip.

What is the Validity of Qatar Travel Insurance?

Your travel health insurance policy for Qatar has some important validity guidelines. The coverage period begins on your arrival date at any border entry point. If you extend your stay beyond the initial visa, you must purchase a new insurance plan.

The minimum policy duration is 30 days – shorter periods are not available. For single-entry visas, your coverage expires as soon as you exit Qatar via air, land or sea. But those with multiple-entry visas remain insured until the policy end date, regardless of temporary departures.

Get Assistance on Qatar Travel Health Insurance

Have questions about securing the required health coverage for your upcoming trip to Qatar? Don’t worry, help is readily available! Simply dial the Ministry of Public Health (MOPH) Helpline 16000 from within Qatar, and select the health insurance extension.

For international tourists calling from abroad, you can reach out to 00974-44069963. Conveniently, you can also email [email protected] with any health insurance queries or complaints related to traveling to Qatar.

The MOPH’s multilingual staff will be delighted to assist you with all your visitor insurance needs and ensure a smooth, stress-free experience when getting covered for your Qatar vacation.

Frequently Asked Questions

Q: How quickly can I get a Qatar health visitor policy?

A: It takes only around 2 minutes! Once you click “Buy Policy”, you’ll be instantly insured.

Q: Is Visitor Insurance mandatory for all Qatar visit visas?

A: Yes, having visitor’s health insurance is compulsory for all types of Qatar visit visas like tourist, family, resident, and on-arrival.

Q: What is the cost of the required Visitor Insurance?

A: The fixed, government-approved price for the minimum visitor insurance coverage in Qatar is a very affordable QAR 50 per month.

Q: Does it cover pre-existing or chronic conditions?

A: No, the visitor health plan does not cover routine treatment for chronic illnesses. However, it will provide emergency assistance if your pre-existing condition suddenly worsens.

Q: What documents are needed to purchase insurance?

A: You’ll need to provide your passport details, mobile number, and an email address to receive your policy documents.

Q: Is the policy valid across the GCC region?

A: No, your Qatar visitor insurance only covers you within the borders of Qatar itself. It does not extend to other GCC nations.

Q: What do I need for emergency treatment in Qatar?

A: During a medical emergency, you must present your passport and Qatar health insurance documents to the treatment providers.

Q: How can I renew my visitor insurance policy?

A: It’s easy! Simply purchase a new plan on the website once your previous policy expires, following the same process.

Q: Can I change the start date of my policy?

A: Yes, if you have a valid reason, you can change the effective date by emailing [email protected] before the original start date.

Q: How do I cancel the insurance?

A: Unfortunately, visitor insurance policies purchased for Qatar cannot be cancelled once issued.

Q: How do I access my policy documents?

A: Your insurance documents will be emailed to the address you provided. You can also get printed copies from the QLM office in Qatar.

Hey there, I’m Hamza Al-Abdullah, the brains and heart behind Qatarvisacheck.qa. Proudly rooted in the bustling city of Doha, Qatar, I’ve made it my mission to untangle the visa web for fellow travelers. My website isn’t just a hub for visa info; it’s a personalized journey through the often confusing world of travel documents.